Understanding Credit and Debit in Accounting: A Comprehensive Guide

In the world of accounting, the concepts of credit and debit are fundamental. These terms are essential for recording financial transactions in a company's ledger. This blog aims to explain the concepts of credit and debit in accounting, their importance, and how they are used in financial statements.

What Are Debits and Credits?

Debits and credits are the cornerstone of the double-entry accounting system. Each financial transaction affects at least two accounts in a way that maintains the accounting equation:

Assets=Liabilities+Equity\text{Assets} = \text{Liabilities} + \text{Equity}Assets=Liabilities+EquityDebits (Dr.)

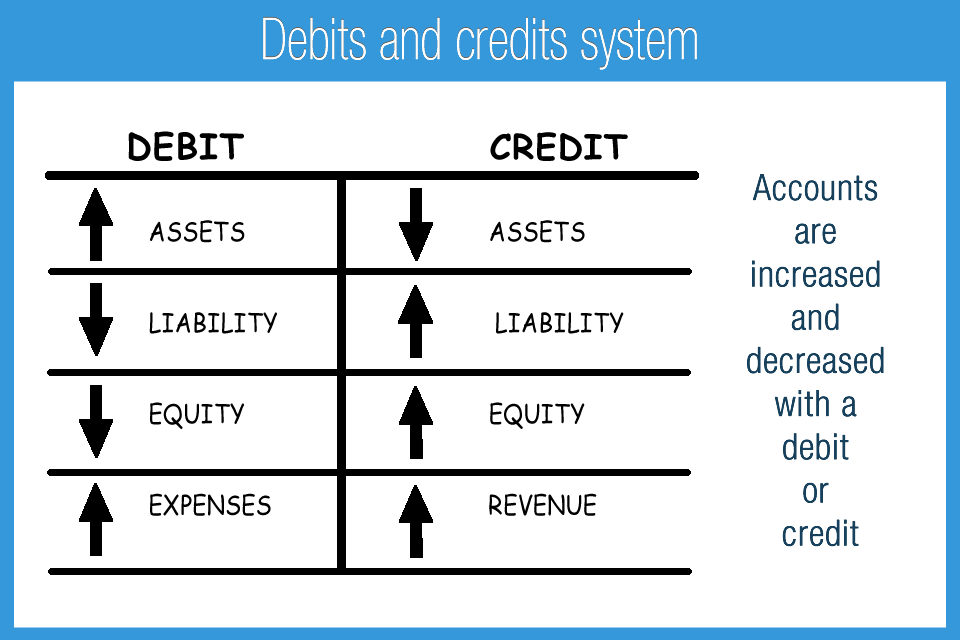

- Definition: A debit is an entry made on the left side of an account.

- Effect: Debits increase asset and expense accounts, and decrease liability, equity, and revenue accounts.

- Example: When a company purchases equipment for cash, the equipment account is debited (increased), and the cash account is credited (decreased).

Credits (Cr.)

- Definition: A credit is an entry made on the right side of an account.

- Effect: Credits increase liability, equity, and revenue accounts, and decrease asset and expense accounts.

- Example: When a company borrows money from a bank, the cash account is debited (increased), and the loan payable account is credited (increased).

The Double-Entry System

The double-entry system ensures that every transaction is recorded twice: once as a debit and once as a credit. This system helps maintain the balance in the accounting equation and provides a comprehensive view of the company's financial situation.

Example of a Double-Entry Transaction

Imagine a company makes a sale on credit worth $1,000:

- Accounts Receivable (Asset): Debit $1,000

- Sales Revenue (Revenue): Credit $1,000

This transaction increases the company's assets (accounts receivable) and its revenue.

Importance of Debits and Credits

- Accuracy:

- The double-entry system helps prevent errors. Each transaction is balanced, ensuring that the total debits equal the total credits.

- Transparency:

- Provides a clear record of all financial transactions, enhancing the transparency of financial reporting.

- Financial Analysis:

- Enables detailed financial analysis by providing comprehensive and systematic records of all transactions.

Practical Application

1. Balance Sheet:

- Assets: Increased by debits, decreased by credits.

- Liabilities and Equity: Increased by credits, decreased by debits.

2. Income Statement:

- Revenues: Increased by credits, decreased by debits.

- Expenses: Increased by debits, decreased by credits.

Real-World Example

Let’s consider a business transaction:

Scenario: A company purchases office supplies worth $500 on credit.

- Office Supplies (Expense): Debit $500

- Accounts Payable (Liability): Credit $500

This transaction reflects an increase in office supplies expenses and an increase in liabilities, specifically accounts payable.

Conclusion

Understanding the roles of debits and credits is essential for anyone involved in accounting or finance. They provide a robust framework for recording and analyzing financial transactions, ensuring accuracy and transparency. Mastering these concepts can lead to more effective financial management and better decision-making within an organization.

For further reading and a more detailed understanding of debits and credits, you can refer to resources like:

By keeping these principles in mind, you can enhance your accounting skills and ensure your financial records are accurate and reliable.